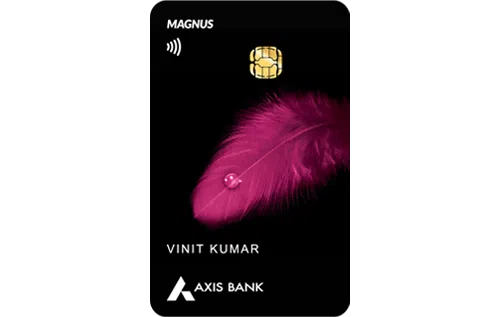

The Magnus Credit Card is one of the most rewarding and sought-after cards in Axis Bank’s portfolio. This super-premium card issued by the bank targets high-income individuals who want to enjoy the privilege of a luxurious lifestyle. It has a joining fee of Rs. 12,500 but offers many premium travel, lifestyle, dining, and insurance benefits. Cardholders get domestic and international lounge access at airports along with a 24*7 concierge service. Premium customers can also make international transactions at a relatively low 2% Forex Markup fee. Also, there are no cash withdrawal charges on the card (Interest charges applicable). Although the annual fee of the card is relatively high, you can get it waived by spending 25 lakhs or above in the previous anniversary year and save Rs. 12,500.

Grab an Axis Bank Magnus Credit Card with just a click and get exciting rewards and offers

Note: It will not affect your score

12 Axis EDGE REWARDS Points for every Rs. 200 spent with the card, 5X EDGE REWARDS on travel spends via TRAVEL EDGE

Unlimited complimentary international airport lounge access for primary cardholders and 8 complimentary visits for the guests every year with Priority Pass

Unlimited Free Domestic Airport Lounge Access

Axis EDGE REWARDS Points can be redeemed on the EDGE REWARDS portal at a value of 1 Edge Reward = Re. 0.20 or Transfer to Partner Airlines/Hotels Rewards Program.

Annual fee waived off on an expenditure of Rs. 25 lakhs in the preceding year.

1% fuel surcharge waived off at all fuel stations across India

2% of the transaction plus GST