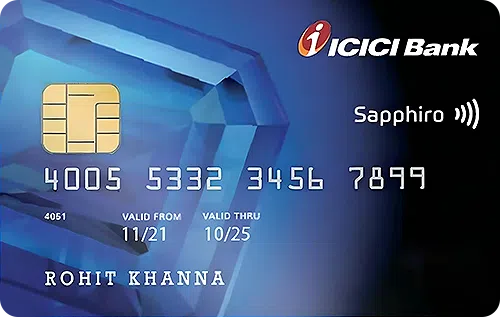

ICICI Bank Sapphiro Credit Card is the second most premium card the bank offers, just after the ICICI Emeralde Private Credit Card. The Sapphiro Card is issued with a yearly fee of Rs. 6,500, and you can enjoy an array of privileges, attractive offers, and user-friendly features. The card comes in three variants – the ICICI Bank Sapphiro AmEx Credit Card, the ICICI Bank Sapphiro Visa Credit Card, and the Mastercard variant. The card is best for frequent travelers and people who aim to have a card with maximum saving opportunities, entertainment benefits, and many other advantages. With exclusive welcome benefits worth more than the joining fee, ICICI Bank aims to give a great start to your journey with this card. You get rewarded for almost every purchase using your ICICI credit card. Be it domestic/international purchases, utility bill payments, fuel purchases, or anything else, you will save every time you spend.

Grab an Sapphiro Credit Card with just a click and get exciting rewards and offers

Note: It will not affect your score

Get Rs. 500 off on the second movie or event ticket when you buy one ticket from Book My Show.

Redeem reward points earned for cash back or gifts at a rate of 1 RP = Re. 0.25.

Complimentary golf rounds/lessons every quarter

2 complimentary International Airport Lounge Access every year through the Dreamfolks membership.

On every Rs. 100 spent, get 4 Reward Points per Rs. 100 spent on international purchases & 2 Reward Points on domestic purchases.

Complimentary Domestic & International Airport Lounge visits and complimentary Spa Sessions at select Domestic airports under the Dreamfolks Membership Programme.

2 complimentary domestic lounge visits with the MasterCard & Amex variant each, and 4 complimentary domestic lounge access with the Visa variant.

Air accident insurance (worth Rs 3 crores), Credit Shield Cover worth Rs 50,000 and other travel-related Insurance Covers.

Renewal fee waiver on spending Rs 6 Lakhs annualy.

3.4% per month (or 40.8% per annum)

Rs. 99 (plus applicable taxes) per redemption request

1% of Fuel Surcharge Waiver (Maximum Rs 250 per billing cycle) at all fuel stations in India.

3.50% of the total transaction value.

2.5% of the total transaction amount (minimum Rs. 300)