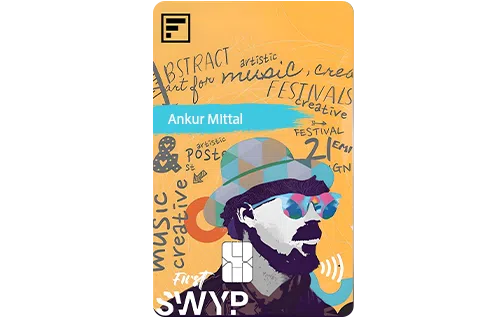

The FIRST SWYP Credit Card by IDFC Bank is an innovative offering in the Indian credit card market. It offers an array of benefits, including reward points and discounts on popular brands like Tata CLiQ, Zomato, and Dominos, making it highly appealing to youngsters. The card can be availed at a low joining fee of Rs. 499 and can even be linked to your UPI apps. What makes this card unique is that at the end of each cycle, you must pay the total amount due or convert it into easy EMI spends. Unlike conventional credit cards, you won’t have to pay hefty interest with this credit card. If unable to clear your dues, you can simply convert your spends into flexible EMIs, starting from a tenure of 3 months and a minimum transaction of Rs. 2,500.

Grab an Idfc Bank First Swyp Credit Card with just a click and get exciting rewards and offers

Note: It will not affect your score

4 Free Railway Lounge Access Each Quarter

Points Can be Redeemed at IDFC First Rewards. Pay With Points Facility Also Available

25% Discounts on Movie Tickets

200, 500, and 1,000 RPs on Spends of Rs. 5,000, 10,000, and 15,000 Respectively

Complimentary Insurance Covers are Provided

Rs. 99

1% Up to Rs. 200 (Monthly)

3.5%

Rs. 199