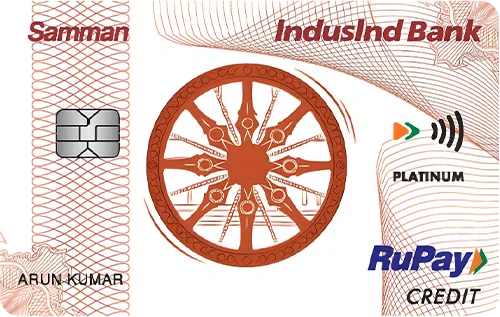

The Samman Credit Card by IndusInd Bank is an exclusive card for government sector employees. This card offers basic benefits like a 1% cashback on spends of up to Rs. 20,000. There is no joining fee for this credit card, although there is a renewal fee of Rs. 199, which can be waived by spending Rs. 75,000 in a year. One of the most noteworthy features of this card is that it has zero cash withdrawal fees. This would be highly beneficial, as you can withdraw cash for any expenses without incurring any charges.

Grab an Indusind Bank Samman Rupay Credit Card with just a click and get exciting rewards and offers

Note: It will not affect your score

1% Cashback on Spends of Rs. 20,000 in a Statement Cycle (Max Rs. 200)

1% Surcharge Waiver on Railway Transactions